Do I Need to Worry?

You may think estate planning is only for the wealthy. Actually, estate planning is a positive step to take to ensure your wishes for your assets are properly fulfilled following your death. If you have assets worth $675,000* or more, your estate may be subject to federal taxes, which can be as high as 55% of the taxable estate.

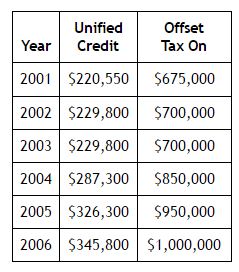

* The amount of assets shielded from federal estate taxes by the unified credit have been gradually increasing beginning in 1998.

You may think estate planning is only for the wealthy. Actually, estate planning is a positive step to take to ensure your wishes for your assets are properly fulfilled following your death. If you have assets worth $675,000* or more, your estate may be subject to federal taxes, which can be as high as 55% of the taxable estate.

* The amount of assets shielded from federal estate taxes by the unified credit have been gradually increasing beginning in 1998.

Adding up your own assets can be an eye-opening experience. By the time you account for your home, investments, retirement savings and life insurance policies, you may find your estate in the taxable category.

Even if your estate is not likely to be subject to federal estate taxes, estate planning may be necessary to be sure your intentions for disposition of your assets are carried out.

Even if your estate is not likely to be subject to federal estate taxes, estate planning may be necessary to be sure your intentions for disposition of your assets are carried out.